Beyond the Checklist: How Intelligent Transaction Management is Revolutionizing Real Estate

Why traditional checklists are failing modern real estate professionals and how AI-powered platforms are transforming the industry

Real estate Transaction Coordinators and brokers have long relied on checklists as the backbone of managing deals. A checklist (whether a paper form or spreadsheet) itemizes all the tasks and documents needed from contract to close. While checklists are indispensable for ensuring nothing gets forgotten, traditional checklists come with serious limitations in today’s fast-paced market.

The Trouble with Traditional Checklists

Manual & Static Operations

Coordinators often spend 30–60 minutes per file re-entering data, chasing signatures, and pasting dates into spreadsheets—just to keep a checklist updated. Every new transaction means repeating this clerical work, burying coordinators in data entry instead of focusing on high-value activities that actually move deals forward.

Error-Prone by Design

Static checklists don’t catch errors or adapt to changes. If an agent forgets a signature or submits an outdated document, a basic list won’t raise a red flag—everything relies on human vigilance. In an industry where a single missed deadline can kill a transaction, this manual approach creates unnecessary risk.

Fragmented Processes Create Chaos

Checklists often live in silos, unintegrated with email, calendars, MLS systems, or e-signature platforms. This fragmentation forces duplicate data entry across multiple systems, “raising the risk of human mistakes and data inaccuracies.” (PropTechOutlook)

The Hidden Cost of Inefficiency

With the average real estate transaction requiring roughly 40 hours of work end-to-end, at 25 deals a year that’s about 1,000 hours spent on transaction admin by a typical Realtor. No wonder one agent described busy weeks as “running around with my hair on fire.”

This represents a massive opportunity cost. Those 1,000 hours could be spent on lead generation, client relationship building, and business development—activities that actually drive revenue growth.

Complex Transactions Demand More Than a Checklist

Modern real estate transactions have only grown more complex and fast-moving. Coordinators aren’t just ticking boxes; they’re managing a sophisticated web of interconnected processes:

Multi-Faceted Transaction Components

- Contingencies and deadlines with cascading dependencies

- Communications across multiple stakeholders and time zones

- Compliance checkpoints with ever-changing regulations

- Financing and appraisal issues requiring real-time coordination

- Inspections, repairs, title, and escrow processes with strict timelines

Stakeholder Coordination Complexity

Each transaction involves numerous parties—buyers, sellers, agents, lenders, inspectors, attorneys, title companies—and dozens of documents that must be completed in precise sequence. A static checklist might list what needs to be done, but it doesn’t help you manage when and how things get accomplished in a dynamic, fast-changing environment.

Rising Regulatory Demands

Many brokers cite missed deadlines and poor task management as a top pain point that jeopardizes transactions.

Regulatory compliance has tightened significantly. Brokers must retain complete transaction files for years and ensure every form is correctly filled out and signed. A basic checklist might list the required documents, but it won’t verify correctness, versioning, or regulatory compliance.

Evolution to DTM 2.0: From Paperwork to Intelligent Workflows

Digital Transaction Management (DTM) 2.0 systems do more than digitize documents—they orchestrate the entire closing process with intelligence, automation, and seamless integration across all platforms and stakeholders.

Key Capabilities of DTM 2.0 Platforms

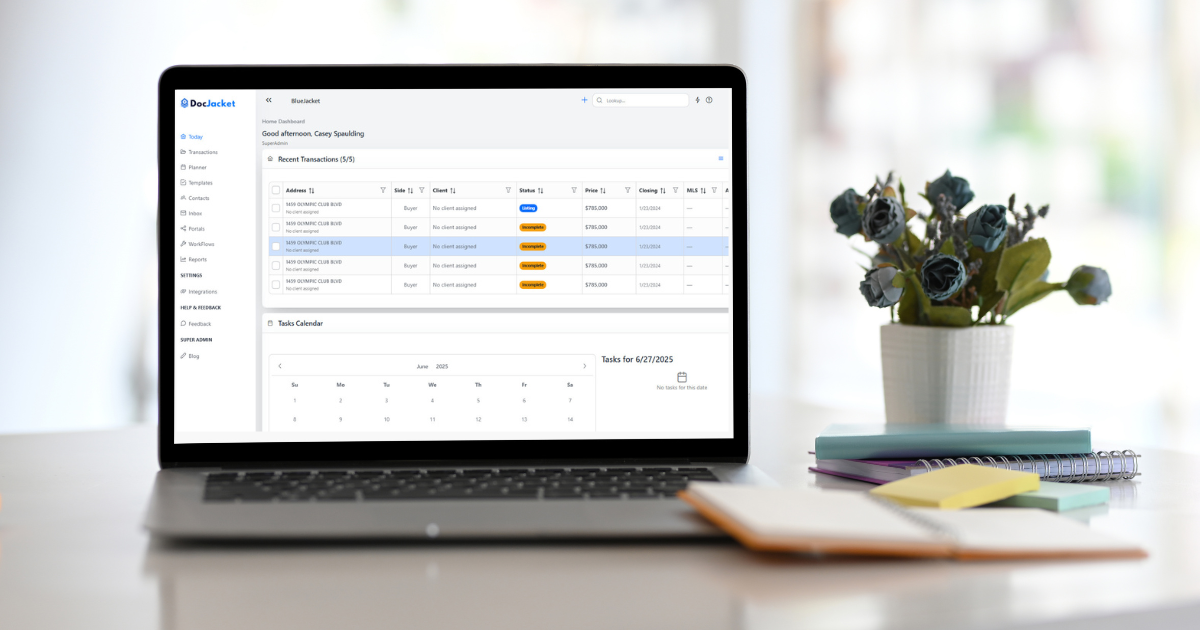

AI-Driven Data Extraction & Smart Checklists

Modern software reads an executed contract PDF, automatically extracts critical details, and builds a tailored checklist in seconds—no manual data entry required.

“Uploading a PDF and still typing 42 fields is 1999.”

Advanced systems understand context, recognize standard clauses, and can differentiate between different document types automatically.

Automated Reminders & Deadline Tracking

Intelligent systems vigilantly monitor every date and deadline, sending email, SMS, and in-app alerts before issues become problems. Overdue items get flagged immediately, reducing missed deadlines by up to 60%.

Real-Time Compliance Checks

Continuous auditing against customizable checklists ensures nothing falls through the cracks. Machine learning verifies document presence, completeness, and signatures, so quick audits can flag issues before closing day disasters.

Seamless Platform Integrations

Modern DTM connects with e-signature platforms (DocuSign, Adobe Sign), calendars (Google Calendar, Outlook), CRMs (Chime, Follow Up Boss), and more—eliminating data silos and duplicate entry.

Intelligent Communication & Collaboration

Built-in messaging, templated emails, SMS notifications, and client portals keep every party informed with complete audit trails and accountability.

Legacy Tools vs. AI-Powered Platforms: A Detailed Comparison

| Feature | Legacy Checklists | AI-Powered Platforms |

|---|---|---|

| Data Entry | Manual entry into spreadsheets or generic software | Auto-parses contracts and populates fields & dates |

| Task Management & Checklists | Static templates—coordination is manual | Dynamic, conditional checklists with auto-completion |

| Reminders & Notifications | Personal calendar entries & manual emails | Automated reminders via email, SMS, and in-app |

| Compliance & Quality Control | Manual audits at close or periodically | Continuous, proactive compliance monitoring |

| Integration & Workflow | Patchwork of unconnected tools | Pre-built connectors & open APIs for seamless flow |

| Error Detection | Relies entirely on human vigilance | AI flags missing documents, incorrect dates, incomplete signatures |

| Scalability | Each new transaction requires same manual effort | Automation scales efficiently with transaction volume |

| Client Communication | Manual updates and status reports | Automated client portals with real-time progress updates |

Real Results: How Intelligent DTM Transforms Performance

1. Dramatic Time Savings & Productivity Gains

Early adopters handle approximately 30% more files without adding staff. Agents save 10–20 hours per transaction when coordinators use intelligent systems, allowing them to focus on revenue-generating activities.

2. Significant Error Reduction & Compliance Improvement

Automated workflows can cut error rates by approximately 60%, drastically reducing audit failures and brokerage risk exposure. This translates to fewer deal delays, reduced legal exposure, and improved client satisfaction.

3. Faster Closings & Enhanced Client Satisfaction

Progressive brokerages report closings up to 5 days quicker on average, boosting referrals and repeat business. Faster closings mean happier clients, better reviews, and increased market share.

4. Reduced Stress & Improved Work-Life Balance

Coordinators can trust intelligent systems to catch issues automatically—no more “hair-on-fire” days. New staff can onboard faster with standardized, automated processes, reducing training time and improving consistency.

5. Enhanced Business Intelligence

Modern platforms provide comprehensive analytics on transaction performance, bottlenecks, and trends, enabling data-driven business decisions and process optimization.

Implementation Strategy: Thinking Beyond the Checklist

Assess Your Current State

- Identify bottlenecks in your current process (missed emails, duplicate entry, last-minute compliance issues)

- Calculate time spent on manual tasks that could be automated

- Document pain points that cause stress and errors in your workflow

Evaluate DTM 2.0 Solutions

- Research platforms offering AI extraction, automated workflows, and deep integrations

- Request demos focusing on your specific use cases and transaction types

- Calculate ROI based on time savings, error reduction, and efficiency gains

Plan Your Digital Transformation

- Treat transaction coordination as a tech-enabled discipline—invest in proper training and tools

- Foster a culture that fully leverages automation and intelligent workflows

- Set measurable goals for improvement in efficiency, accuracy, and client satisfaction

Implementation Best Practices

- Start with pilot programs using your most tech-savvy coordinators

- Provide comprehensive training on new systems and workflows

- Gather feedback and refine processes based on real-world usage

- Scale gradually while monitoring performance and user adoption

The Future of Real Estate Transaction Management

The evolution from manual checklists to intelligent automation represents more than just a technology upgrade—it’s a fundamental shift in how real estate professionals operate. As client expectations continue rising and market competition intensifies, embracing intelligent transaction management isn’t just an advantage—it’s becoming essential for survival.

When your paperwork chaos is under control, you’re free to focus on what really matters: closing deals and delighting clients.

The question isn’t whether to evolve beyond traditional checklists, but how quickly you can implement intelligent systems that transform your transaction management from a burden into a competitive advantage.

Ready to move beyond basic checklists? The future of real estate transaction management is here, and it’s powered by artificial intelligence that works as hard as you do—but never makes mistakes, never forgets deadlines, and never needs a coffee break.