New industry research reveals the hidden financial challenges facing transaction coordinators—and the technology solutions that are transforming the profession

The Bottom Line: Despite written contracts and industry-standard practices, many transaction coordinators struggle with payment timing and collection issues. Our comprehensive analysis of the nation’s largest TC communities reveals systemic challenges threatening the financial stability of independent coordinators—and how artificial intelligence is emerging as the solution.

## Key Research Findings:

- Most TCs struggle with payment collection even with signed contracts

- Minority have attorney-drafted agreements that provide real legal protection

- Many now charge cancellation fees ($50-$100) to protect against deal fallouts

- Offshore VA services at $25-$50 per file are commoditizing basic TC tasks

- AI-powered automation is becoming the competitive differentiator for premium TC services

The Hidden Challenge: When Contracts Don’t Guarantee Payment

The Reality of TC Collections

“Means shit unless you’re going to drag them to court, which most are not.”

This blunt assessment from a veteran transaction coordinator moderator in the 20,000-member “Transaction Coordinators and Admins for Real Estate” Facebook group captures the harsh reality facing independent TCs nationwide. Despite having written service agreements, many transaction coordinators face significant challenges collecting payment for their services.

The quote, which received dozens of supportive reactions from practicing TCs, illustrates a fundamental disconnect between the legal theory of contracts and the practical reality of small business collection efforts in the real estate industry.

Understanding Payment Collection Challenges

Our analysis of discussions from the nation’s largest TC communities reveals concerning patterns that paint a picture of an industry facing financial difficulties:

Contract Enforcement Challenges:

- Limited TCs have attorney-drafted contracts with enforceable payment terms and proper legal structure

- Most TCs avoid litigation despite having legal grounds for collection due to cost and time constraints

- Small claims court filing costs ($30+ per case) often exceed the practical benefit for smaller disputed amounts

- BIC (Broker-in-Charge) involvement remains the most common first escalation step, with mixed success rates

Collection Escalation Process:

The typical collection process follows a predictable but often ineffective pattern:

- Late fees ranging from 20-50% upcharges after 15-30 days

- Broker intervention - contacting the agent’s managing broker

- State board complaints - threatening professional license action

- Collections agencies - after 60+ days of non-payment

- Small claims court - the nuclear option most TCs avoid

Payment Protection Evolution:

Recognizing the collection challenges, TCs are adapting their business models:

- Many now get paid at closing through escrow to remove agent control over payment timing

- Credit card on file policies gaining popularity with automatic 15-day payment terms

- Collections agencies being implemented with 60-day payment deadlines

- State board complaints being used as leverage against chronically non-paying agents

## Industry Insight

The Real Cost of Payment Delays: Transaction coordinators operating on the traditional "pay at closing" model face significant cash flow challenges. With deals taking 30-45 days to close and cancellation rates varying by market, TCs often work for weeks without compensation, creating a feast-or-famine income cycle that threatens business sustainability.

The Rise of Cancellation Fees: Protecting Against Deal Fallouts

The widespread adoption of cancellation fees represents the industry’s pragmatic response to payment risk:

Standard Cancellation Fee Structure:

- $50 fee during inspection period (deals cancelled within first 10 days)

- $100 fee after due diligence (deals cancelled after contingency periods)

- $75 average cancellation fee across all markets and service levels

- Many TCs now implement some form of cancellation protection

Why Cancellation Fees Work:

Unlike collection efforts for completed transactions, cancellation fees serve as both revenue protection and client education. They establish clear expectations about the value of TC services from the beginning of the relationship, rather than attempting to justify payment after problems arise.

Regional Variations: The $350 Pricing Spread Reveals Market Maturity

Geographic Pricing Analysis

The transaction coordination market shows significant regional variations in both pricing and payment practices, indicating different levels of market maturity and professional recognition:

Premium Markets:

- California: $650 contract-to-close per side for licensed TCs

- Utah: $500 full-service standard with required licensing

- Texas: $300-$600 three-tier packages with $450 as the most popular option

Service Tier Preferences:

“Overwhelming majority choose the $450 tier” - Texas-based TC with over 5,000 closed transactions

The preference for middle-tier pricing across markets suggests that TCs have found the sweet spot between affordability and comprehensive service. This pricing pattern also indicates that clients value choice and are willing to pay moderate premiums for additional services.

Three-Tier Pricing Models Dominate:

The standardization of three-tier pricing structures ($300/$450/$600 being most common) across diverse geographic markets suggests a mature understanding of client psychology and service differentiation. This pricing strategy allows TCs to:

- Capture price-sensitive clients with basic services

- Generate primary revenue from mid-tier comprehensive packages

- Serve premium clients who want full-service coordination

Post-NAR Settlement Impact: The Compliance Premium

The recent NAR settlement has created new dynamics in the TC market, particularly around licensing and compliance expertise:

Increased Demand for Licensed TCs:

“I’m seeing an uptick in agents wanting a licensed TC when I meet with them.” - Industry veteran with 28 years of experience

Compliance Concerns Driving Premium Pricing:

- Licensed TCs can command $200+ premium over unlicensed coordinators in many markets

- Agents increasingly value compliance expertise over pure cost savings

- Professional liability coverage becoming a standard client expectation

- Regulatory knowledge becoming a competitive differentiator

State-by-State Licensing Requirements:

The regulatory landscape varies significantly by state, creating opportunities for TCs who understand the compliance requirements:

- Texas: License required for TC work (multiple industry confirmations)

- Utah: License required plus brokerage affiliation oversight

- California: License required for certain coordination activities

- Most other states: Allow unlicensed TC work with specific restrictions

The Offshore Challenge: VA Services Disrupting Traditional TC Models

The $25 File Processing Competition

One of the most significant emerging threats to traditional TC business models comes from offshore virtual assistant services that are commoditizing basic transaction coordination tasks.

Market Disruption Data:

- $25-$50 per file - Offshore VA services for basic intake and compliance tasks

- $8-$15 per hour - Direct hourly competition from overseas providers

- $18-$25 per hour - Domestic VA alternatives offering similar services

- “2+ years of TC experience” - Standardized skill development becoming common in VA market

Services Being Commoditized:

The offshore VA market is specifically targeting the most routine aspects of transaction coordination:

- File setup and initial intake - Basic data entry and document collection

- Compliance document management - Uploading and organizing standard forms

- Basic client communication - Templated status updates and reminders

- Deadline tracking - Calendar management and reminder systems

Why Low-Cost Models Struggled (And What That Means)

Scalability Challenges:

“The service wasn’t scalable, and offering contingent payment upon successful transaction completion also didn’t work for them.” - Business owner who attempted to build a $25-per-file TC service but pivoted to other areas

This insight reveals the fundamental challenges with ultra-low-cost TC models:

- Quality control issues at scale

- Cash flow problems with contingent payment structures

- Client relationship management difficulties with overseas providers

- Communication barriers affecting client satisfaction

Quality Concerns Emerging:

The push toward lower-cost alternatives is creating noticeable quality issues in the industry:

- Communication standards declining - Noted by multiple experienced TCs

- “Tighten your written communication” - Professional development feedback becoming more common

- Client relationship management - Cannot be effectively outsourced without service degradation

The AI Solution: Automated Systems That Actually Work

How Technology Solves Payment Collection

The payment challenges facing transaction coordinators aren’t just a collection problem—they’re workflow and communication problems that technology can solve systematically.

Automated Invoice Generation:

Modern AI systems can monitor transaction milestones and automatically generate invoices when deals reach specific stages:

- Contract acceptance - Immediate service initiation fee billing

- Contingency removal - Progress milestone invoicing based on completion

- Closing completion - Final payment processing with escrow coordination

- Deal cancellation - Automatic cancellation fee calculation and billing

Smart Payment Protection:

AI-powered systems can implement sophisticated payment protection that goes beyond simple contracts:

- Credit card authorization - Secure, PCI-compliant automated payment processing

- Escrow integration - Direct API connections for payment from closing proceeds

- Payment status tracking - Real-time visibility into collection status and aging

- Automated follow-up - Professional payment reminders without manual effort or awkward phone calls

Beyond Payment: Comprehensive Workflow Automation

The Compliance Automation Opportunity:

Recent discussions in TC communities reveal sophisticated automation requests:

“I would love to use it for a compliance email. Anything not checked as fully executed would populate into an email with what is outstanding and who still needs to sign.”

This type of request illustrates how TCs are thinking beyond basic task management toward intelligent workflow automation that can:

- Monitor document completion status across multiple platforms

- Generate professional status updates without manual drafting

- Identify compliance gaps before they become deal-threatening issues

- Automate client communication while maintaining professional standards

AI-Powered Solutions Emerging:

The next generation of TC tools leverages artificial intelligence to provide:

- Document completion tracking - Automatic monitoring of signature status across platforms

- Missing document detection - Instant identification of compliance gaps using document AI

- Automated status updates - Professional client communication generated from transaction data

- Deadline management - Proactive alerts and escalation before critical dates

## Technology Advantage

Email Integration Revolution: The most sophisticated TC automation systems now monitor email communications from transaction management platforms, automatically updating deal status and generating appropriate responses. This eliminates the "back and forth" frustration that causes TCs to miss critical updates.

The Professional Evolution: From Manual to Intelligent

Why Premium TCs Are Embracing AI

Competitive Differentiation:

While offshore VAs compete purely on price, AI-powered TCs compete on value and results:

- Instant response times - No delays for overseas communication or time zone coordination

- Perfect accuracy - Elimination of human error in data entry and deadline tracking

- Professional presentation - Consistent, polished client communication every time

- Scalability without quality loss - Ability to handle more transactions without compromising service standards

Revenue Protection Through Technology:

- Reduced payment disputes - Clear, automated billing processes with documentation

- Higher completion rates - Proactive deadline and compliance management preventing deal failures

- Premium pricing justification - Technology investment enables higher fees through superior service

- Client retention - Superior service quality through automation creates switching costs

Market Positioning Strategy for TCs

For Transaction Coordinators:

- Position AI tools as professional development investment rather than expense

- Emphasize revenue protection and business sustainability over cost savings

- Highlight competitive advantage against both traditional competitors and low-cost alternatives

- Focus on client satisfaction improvements that justify premium pricing

For Real Estate Agents:

- Demonstrate risk reduction through automated compliance monitoring

- Show time savings through intelligent workflow management and status updates

- Prove communication improvements via automated, professional client updates

- Quantify deal success rates with proactive deadline management and issue resolution

Industry Outlook: The Next 24 Months

Technology Adoption Trends

Early Adopter Advantage:

Transaction coordinators implementing AI-powered systems now are establishing competitive moats that become increasingly difficult for traditional competitors to replicate:

- Client relationship lock-in through demonstrably superior service delivery

- Operational efficiency enabling higher transaction volumes without proportional cost increases

- Professional reputation based on consistent, error-free execution and communication

- Premium pricing sustainability justified by measurable, superior results

Market Consolidation Indicators:

Several trends suggest the TC industry is approaching a period of consolidation:

- Low-cost providers struggling with scalability and quality issues at volume

- Licensed TCs commanding significant premiums in the post-NAR compliance-focused market

- Technology investment becoming a practical barrier to entry for new competitors

- Client expectations rising for automated, professional service delivery standards

Recommendations for Transaction Coordinators

Immediate Actions (Next 90 Days):

- Implement automated payment systems - Eliminate collection disputes before they can start

- Invest in compliance automation - Position for post-NAR settlement requirements and opportunities

- Develop AI-powered workflows - Create sustainable competitive differentiation against VA services

- Establish premium pricing structures - Justify higher fees through demonstrably superior technology and service

Long-term Strategy (Next 12-24 Months):

- Focus on high-value client relationships rather than competing purely on price

- Leverage technology for scalable growth without sacrificing service quality or client satisfaction

- Build recurring revenue models through exceptional client retention and service expansion

- Position as compliance and risk management expert in an increasingly regulated market environment

The Future of Transaction Coordination

What Success Looks Like

The transaction coordination industry stands at a critical inflection point. While many TCs currently struggle with payment collection and offshore competition threatens to commoditize basic services, artificial intelligence offers a clear path to professional elevation and financial stability.

The Winners in This Transition Will Be TCs Who:

- Embrace automation to solve systemic payment and workflow challenges proactively

- Use technology to justify premium pricing through measurably superior service delivery

- Focus on compliance and risk management as core value propositions

- Build scalable systems that grow revenue without proportional cost increases

The Losers Will Be Those Who:

- Continue relying on manual processes while hoping for better payment compliance

- Compete purely on price against offshore alternatives

- Ignore the post-NAR settlement compliance requirements and opportunities

- Fail to invest in technology that clients increasingly expect

The Payment Problem Is Real, But It’s Also Solvable

Transaction coordinators who continue operating with traditional manual processes and hoping for better payment compliance will find themselves increasingly pressured by low-cost alternatives and changing client expectations. Those who invest in intelligent automation will discover that technology doesn’t just solve the payment challenges—it transforms the entire business model.

The data is clear: the future belongs to TCs who recognize that artificial intelligence isn’t replacing human expertise; it’s amplifying it. In a market where contracts “mean shit unless you’re going to drag them to court,” smart automation ensures you never have to.

The payment challenges facing many transaction coordinators are not inevitable—they’re solvable through intelligent application of technology, professional positioning, and strategic business model evolution.

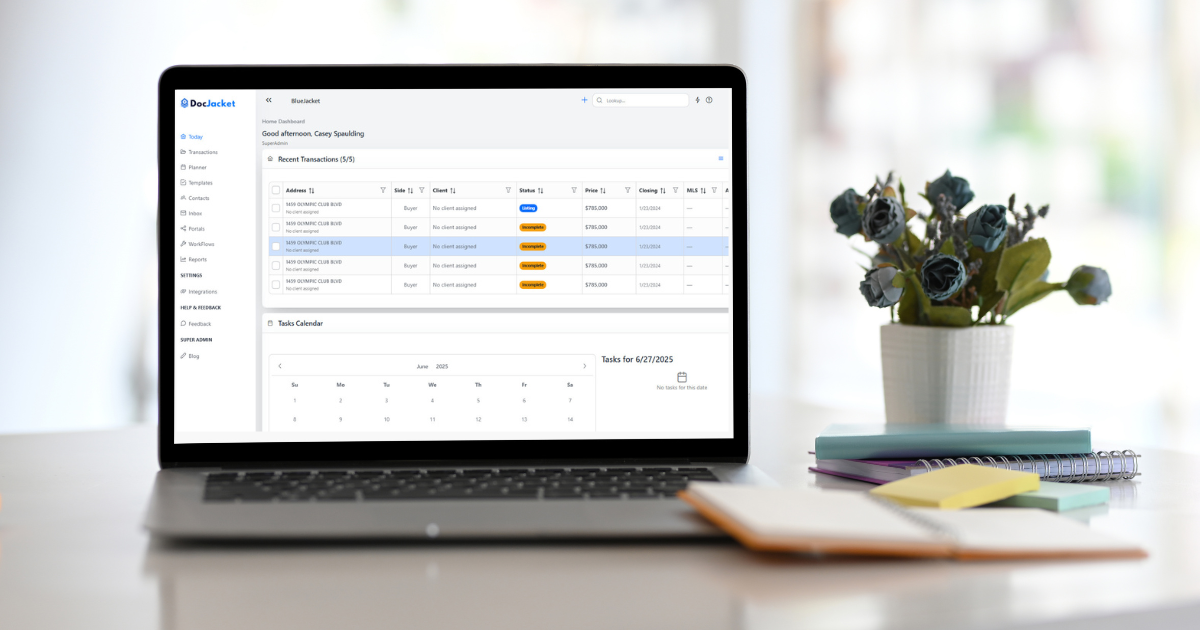

## Ready to Solve Your Payment Challenges?

See how DocJacket's AI-powered automation helps prevent payment disputes

Automated invoicing • Compliance monitoring • Payment tracking • Deal status updates

Schedule Free DemoAbout This Research

This comprehensive analysis is based on extensive discussions from the nation’s largest transaction coordinator communities, including the 50,000+ member Facebook group and other major TC forums. The data represents real-world experiences from practicing transaction coordinators across all major US markets, with geographic representation from California, Texas, Utah, Ohio, Massachusetts, and other key states.

Research methodology included analysis of payment discussions, pricing surveys, technology adoption patterns, and workflow challenges discussed in professional TC communities over a six-month period in 2024-2025.

For more insights on transaction coordinator technology and industry best practices, visit DocJacket.com